What are the different Methods of Floatation of Securities in Primary Market?

SBI Card’s initial public offering (IPO) in 2020 was the most important IPO of a credit card firm and one of the many largest IPOs within the banking sector. Many buyers believed the stock’s worth would in a short time improve on the secondary market because of the company’s reputation. Because of excessive demand within the primary market, underwriters priced the stock at ₹ 750 per share, on the high of the focused range, and raised the stock providing level by 25% to 137 million shares. The stock valuation turned $103.54 billion, the biggest of any newly public firm. Both the primary market and the secondary market are aspects of a capitalist financial system, in which money is raised by the buying and selling of securities—financial assets like stocks and bonds.

- Some of the most typical and well-publicized primary market transactions are IPOs or preliminary public choices.

- Capital raised through an IPO will then become the issuing company’s equity capital.

- If you have any particular questions, you should check the privacy statement that appears on each co-branded site.

Dealers will then earn profits based on the spread between the prices at which securities are bought and sold. Therefore, in theory, it should be unnecessary to look for the best price since having all the buyers and sellers together should result in prices that all parties find acceptable. Secondary markets may also allow investors to profit from their investments sooner than they otherwise would. Though both of these markets offer an investor a broad array of securities, there is a significant difference between the two.

What are the main sources for raising capital in the primary market?

Instead, the parties gather together through electronic networks such as NASDAQ, which is the most well-known dealer market. In a dealer market, the interested parties do not need to gather together in a specific location. The concept behind this is that if all interested parties are brought together and announce their prices, it should result in an efficient market. Download our Desktop terminal and Mobile app Desktop terminal and Mobile app to stay on top of the FNO markets. All brokered CDs will fluctuate in value between purchase date and maturity date.

(Tinn, 2017) claims that using blockchain to promote corporate governance and legal frameworks may promote corporate transparency and efficiency when the record is established, and that blockchain technology has enhanced automation. (Sutton and Samavi, 2017) shown that when pre-set criteria are satisfied, equity transactions may be automatically completed by putting smart contract terms into an automated programming language. More specifically, it employs machine learning to assess the desire and ability of borrowers, and it leverages a blockchain-based system to predict the borrower’s future willingness instantaneously. The two parties may negotiate between the two parties or through the “matching” of third-party service agencies to complete the transaction. In this process, there is asymmetric and redundant information in the transaction, making it difficult for both parties to match the transaction accurately, and the transaction time is lengthened indefinitely. At the same time, some trading platforms lack the guarantee of credibility, and the ability to label information is weak.

Primary Market vs Secondary Market

In rights, existing shareholders are offered a discounted price based on their existing shares. Generally, only large investors or those interested in purchasing a large number of securities will take part in sales feature of primary market made in the primary market. In this case, the company making the IPO will be referred to as the issuer, and they will work through investment banks that underwrite the issuance of shares to be sold to investors.

For the OTC market, there is no regulatory authority involved and the parties can directly deal with each other, which leads to counterparty risk. Apart from this, the share valuation is based on the performance of the shares in the market. – Yes, stocks do refer to ownership of a company and thus buying a stock does mean you gain the ownership of a company. It is possible that some investors may have heard of “third” and “fourth” markets, and though the majority of investors will likely never have to be concerned with these markets, it is best to be aware of what they are. The over-the-counter (OTC) market is essentially another term often used to refer to the dealer market. This competition between dealers, in turn, acts to provide investors with the lowest possible prices for securities.

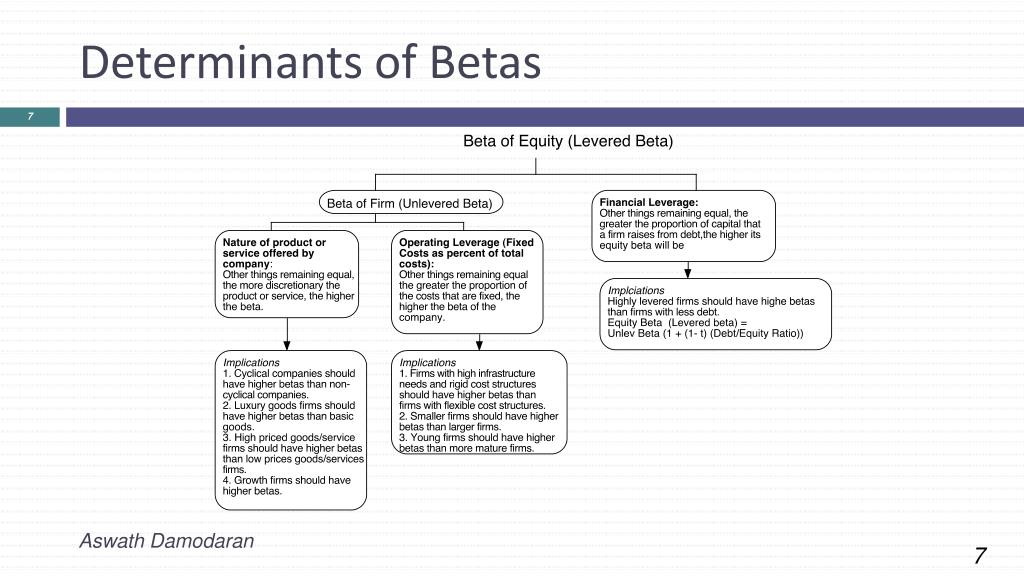

1 Proposed primary financial market systems

Other kinds of major market choices for shares embrace personal placement and preferential allotment. Private placement permits firms to promote on to extra vital buyers similar to hedge funds and banks without making shares publicly accessible. While preferential allotment provides shares to pick buyers (often hedge funds, banks, and mutual funds) at a particular worth not obtainable to most people. Companies should file statements with the Securities and Exchange Board of India (SEBI) and different securities companies and should wait till their filings are authorized earlier than they’ll go public. In the primary market, investors purchase securities directly from the company issuing them. In the secondary market, an individual may purchase shares in a company without the involvement of the issuing company.

These are the decentralized markets, which will mainly consist of the participants that are engaged in trading among themselves. The most important examples of the stock exchange are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). ICICI provides financial services and promotes economic development and growth.

What are the different Methods of Floatation of Securities in Primary Market?

Traditional solutions are challenging to eliminate the cost increase and efficiency loss caused by these problems. In the future, you can consider choosing emerging technologies, such as blockchain, to solve these problems in the primary market. The current traditional solution is to reduce the friction of information/trust issues by introducing a financial agency, proving a lack of efficiency.

Newly listed homes for sale in the Council Bluffs area – The Daily Nonpareil

Newly listed homes for sale in the Council Bluffs area.

Posted: Tue, 08 Aug 2023 18:03:45 GMT [source]

The due diligence process of primary market transactions is mainly carried out through written reviews, on-site inspections, public channel searches, interviews, and entrusted third-party investment. As investors continue to pay more attention to issues such as consistency of interest and information transparency, the level of detail in their preliminary due diligence process has also increased. Although detailed and meticulous due diligence meets investors’ requirements for companies to some extent, it often takes too long, reduces transaction efficiency, and increases transaction costs. On the other hand, due to the lack of a standardized due diligence checklist, some investors do not know the extent of their due diligence on the company.

In addition, based on the following suggestion (Kitchenham and Pfleeger, 2008), that is to provide services to prospective respondents in an appropriate language. Besides the English version of the survey, there is also a Chinese version. The Chinese version of the survey can help Chinese respondents more easily understand the questions from the questionnaire. Again, it may also draw the wrong analysis based on the survey’s answers.

These issues also reflect the same information asymmetry, true and effective information, mutual trust mechanism and other issues. Therefore, these problems can also be solved through blockchain technology. It is urgent to solve problems with complex due diligence processes, mismatching, and difficulty monitoring.

Blockchain technology has gone through the Bitcoin era of blockchain 1.0 and the blockchain 2.0 era represented by the alliance chain. At present, blockchain technology has transitioned to the blockchain 3.0 era represented by EOS. In terms of technical application, according to different actual application scenarios and design concepts, current blockchain projects are heterogeneous blockchains developed using different technical frameworks.

Private placement allows companies to sell directly to more significant investors such as hedge funds and banks without making shares publicly available. Preferential allotment offers shares to select investors (usually hedge funds, banks, and mutual funds) at a special price not available to the general public. Among the 15 respondents, 14 respondents (93.3%) believed that the current due diligence procedures for securities issuance are too complicated, time-consuming, and costly, and they are on the premise of ensuring the quality of issuance.

When trades settle in each market

Learn about the industrial credit and investment corporation of India. Each type of market has its purpose and characteristic features as well. To understand the working of these markets, we need to discuss these markets in detail.

After the interview, the DD (Due Diligence) process will be launched, and if both the interview and DD meet the buyer’s requirements, they will sign a TS (Term Sheet), which can be regarded as a promised investment agreement. TS is a letter of intent to invest and is not subject to legal restrictions. Finally, the buyer and seller will sign SPA (Share Purchase Agreement) and other relevant agreements to confirm the investment contract, which is the final step of the investment activity.

- Proceeds from your purchase go to the issuer of the security, such as a bank for CDs and corporation or government agency for bonds.

- During an IPO, a primary market transaction happens between the buying investor and the funding financial institution underwriting the IPO.

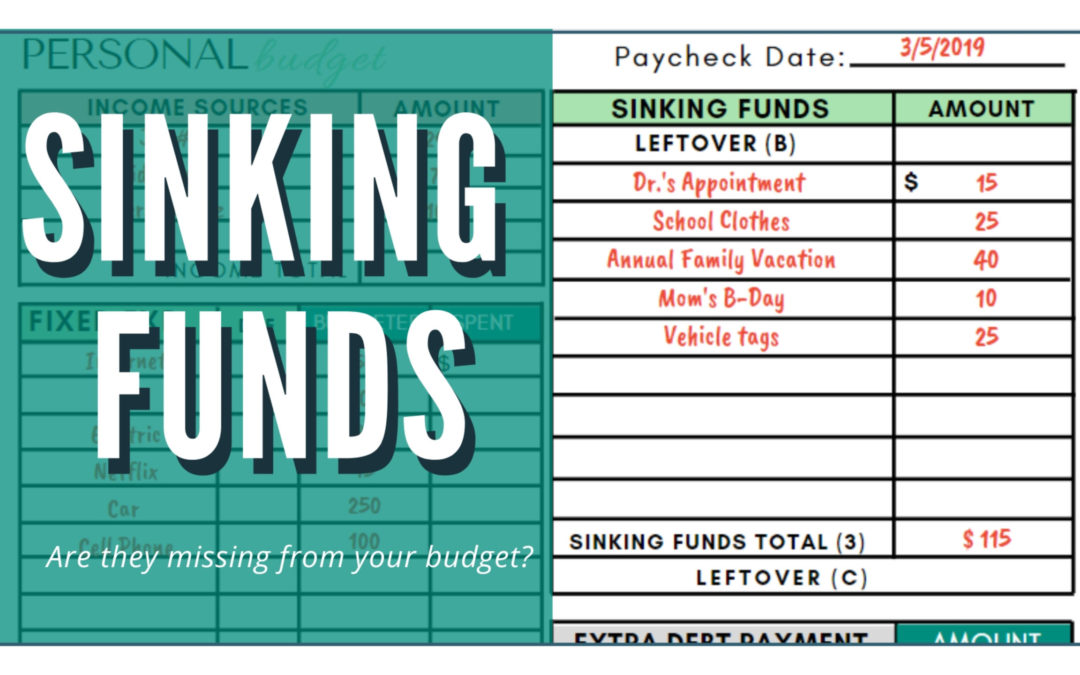

- Pie charts of broad working experience and primary financial market working experience are shown in Figure 3.

- After that, the authors performed a validation survey with 54 participants to confirm various insights from the interviews, including challenges, best practices, and desired improvements based on the interviews.

- These shares are bought by qualified institutional buyers who consist of foreign institutional investors, mutual funds, Insurers and public financial Institutions among others.

In particular, the authors interviewed a total of 15 primary financial involvers with various backgrounds and expertise. They were asked about their everyday work and relevant challenges faced during their responsibilities in the primary financial market during the interviews. Next, the authors adopted open card sorting (Spencer, 2009) to analyze the interview results. The following categories produced by open card sorting were grouped into three groups, i.e., complex due diligence, mismatching, and difficult monitoring. After that, the authors performed a validation survey with 54 participants to confirm various insights from the interviews, including challenges, best practices, and desired improvements based on the interviews. The securities are first introduced in the primary market for subscription to the public.